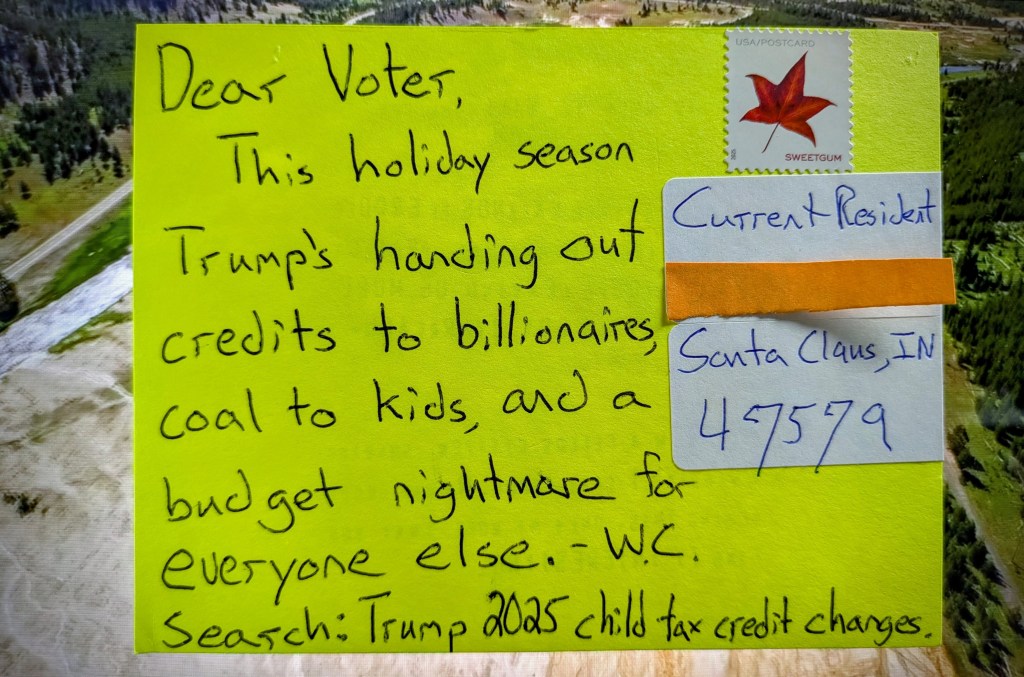

Oct 01, 2025 | Postscape #023

Congress passed the “One Big Beautiful Bill” (OBBB), making many changes permanent, particularly from the 2017 tax cuts. The key update for families is the maximum credit, now $2,200 per kid, plus an inflation adjustment starting in 2026. However, while the top credit increased, the refundable portion remains capped at $1,700, leaving low earners without full benefits. Now, parents must have a valid Social Security Number (SSN) to qualify, cutting out about 2.7 million American kids from the credit.

In Indiana, OBBB carries significant long-term risks for healthcare access, social safety nets, and services critical to lower-income and vulnerable populations. These downsides especially impact rural healthcare infrastructure, social welfare programs, and education support. Public opinion reflects concern, with two-thirds of people viewing the bill unfavorably after learning about increased uninsured rates, hospital funding cuts, and reduced Medicaid spending.

SOURCES

https://www.hrblock.com/tax-center/irs/tax-law-and-policy/one-big-beautiful-bill-taxes/

https://bipartisanpolicy.org/blog/how-the-obbb-changes-to-the-child-tax-credit-will-impact-families/